Demand for MLS listed homes in the Lakelands region is down this June while the overall inventory of properties is the highest it’s been in two years, according to the Lakelands Association of Realtors.

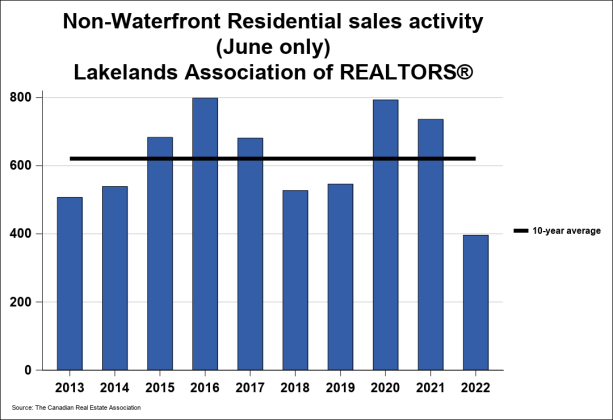

Residential non-waterfront sales activity recorded through the MLS System for the Lakelands region totaled 396 units in June 2022. This was a substantial reduction of 46.2 per cent from the same period in 2021.

Residential non-waterfront sales were 34 per cent below the five-year average and 36.2 per cent below the 10-year average for the month of June.

On a year-to-date basis, residential non-waterfront sales totaled 2,721 units over the first six months of the year. This was a sharp decrease of 30.8 per cent from the same period in 2021.

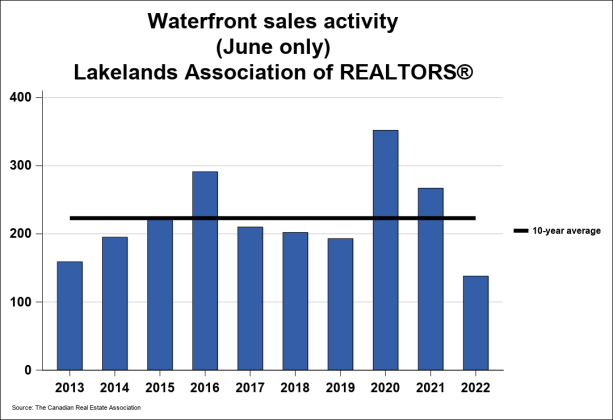

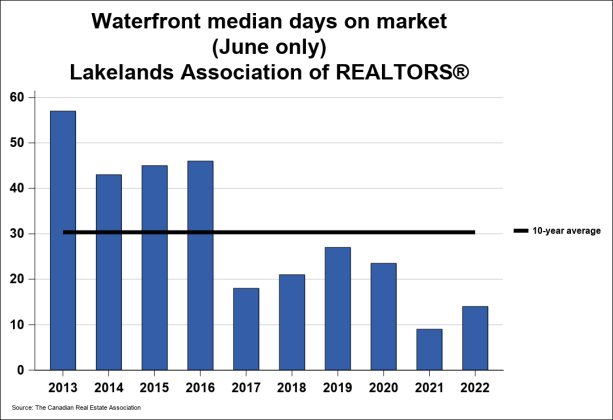

Sales of waterfront properties numbered 138 units in June 2022. This was a substantial reduction of 48.3 per cent from the same period in 2021.

Waterfront sales were 40.1 per cent below the five-year average and 38.1 per cent below the 10-year average for the month of June.

On a year-to-date basis, waterfront sales totaled 610 units over the first six months of the year, significantly decreasing by 48.5 per cent from the same period in 2021.

“As with many markets across the Greater Golden Horseshoe, demand for MLS listed homes has declined at a very fast pace over the last few months, driven in part by the Bank of Canada’s aggressive attempt to tame inflation. Sales totals in June were well below the level we would expect for this time of year. In fact, the number of sales in June was the lowest total for the month since 1996,” said Chuck Murney, President of the Lakelands Association of Realtors.

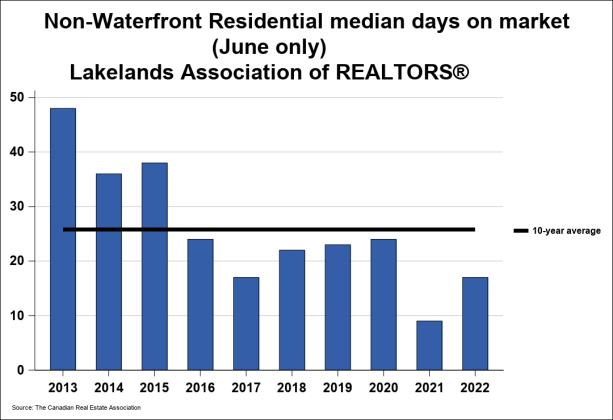

“On the other hand, the number of newly listed properties coming on the market during the same period was above the long-term average. As a result, the number of available homes for sale at the end of June was above 2,000 for the first time in two years. The trifecta of rapidly rising mortgage rates, declining demand and surging listings has shifted the market balance, previously in favour of sellers for a prolonged period, into a buyer’s market for the first time in many years. With additional rate hikes anticipated soon it is reasonable to expect further moderation in our local market in the short term and possibly through the end of the year.”

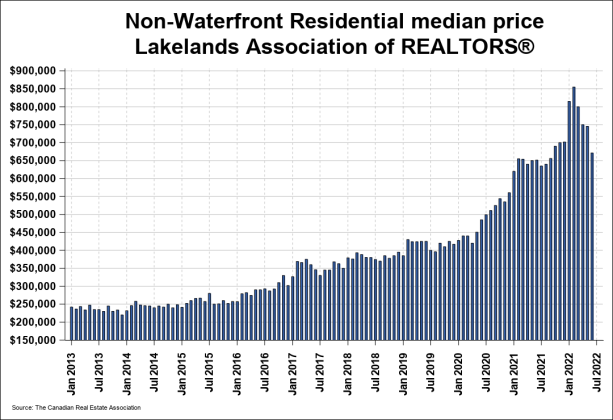

The MLS Home Price Index (HPI) tracks price trends far more accurately than is possible using average or median price measures. The overall MLS HPI composite benchmark price was $777,300 in June 2022, increasing by 11.7 per cent compared to June 2021.

The benchmark price for single-family homes was $802,400, a gain of 11 per cent on a year-over-year basis in June. By comparison, the benchmark price for townhouse/row units was $670,900, up by 18.6 per cent compared to a year earlier, while the benchmark apartment price was $537,100, an increase of 24.9 per cent from year-ago levels.

The median price for residential non-waterfront property sales in June 2022 was $671,250, up modestly by 3 per cent from June 2021.

The more comprehensive year-to-date residential non-waterfront median price was $769,000, an increase of 18.3 per cent from the first six months of 2021.

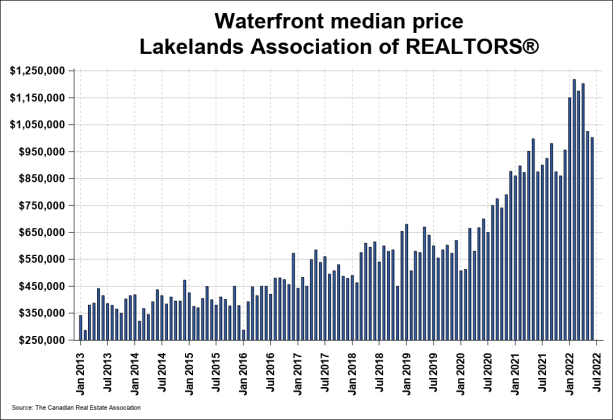

The median price for waterfront property sales in June 2022 was $1,002,500, up by 14.6 per cent from June 2021.

The more comprehensive year-to-date waterfront median price was $1,100,250, an increase of 21.5 per cent from the first six months of 2021.

The total dollar value of all residential non-waterfront sales in June 2022 was $300.6 million, a big decline of 45.3 per cent from the same month in 2021.

The total dollar value of all waterfront sales in June 2022 was $202 million, a substantial reduction of 34.2 per cent from the same month in 2021.