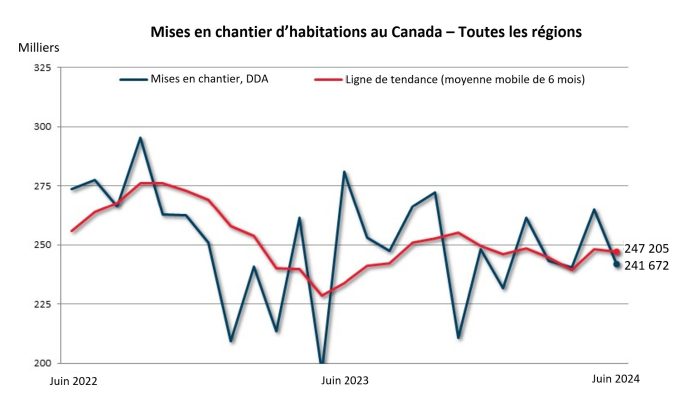

The total monthly seasonally adjusted annual rate (SAAR) of housing starts for all areas in Canada decreased 9% in June (241,672 units) compared to May (264,929), according to the Canada Mortgage and Housing Corporation (CMHC).

The six-month trend in housing starts decreased 0.4% from 248,260 units in May to 247,205 units in June. The trend measure is a six-month moving average of the SAAR of total housing starts for all areas in Canada.

The actual number of housing starts across Canada in urban centres of 10,000 population and over was down 13% to 20,509 units in June compared to 23,518 units in June 2023. The year-over-year decrease was driven by lower multi-unit starts, down 16%, while single-detached starts were similar to last June.

June’s total actual housing starts were markedly lower in two of Canada’s three major cities compared to June 2023, with Toronto down 60% and Vancouver down 55%. Both cities recorded significant declines in multi-unit construction. Montréal was up significantly at 226%, due to much higher multi-unit activity.

Through the first half of 2024, Canada’s six largest Census Metropolitan Areas (CMAs) saw a modest 4% combined year-over-year increase from 2023, driven by higher starts levels in Calgary, Edmonton, and Montréal which made up for decreases in Vancouver, Toronto, and Ottawa. Among the largest of the big six CMAs, Vancouver and Toronto have seen apartment starts slow as high interest rates and weak condominium pre-construction sales appear to be affecting these centres negatively. Meanwhile, Montréal has observed higher multi-unit construction this year, with apartments starts up 63% from the 8-year low recorded in 2023. Also of note is the higher construction activity in Calgary and Edmonton as starts increased across all dwelling types, driving total starts up 38% and 67% respectively.

CMHC’s next Housing Supply Report, to be released in the Fall, will examine these trends in greater detail. See Table 1 below for more information.

Quote:

“The higher interest rate environment appears to have caught up with some of Canada’s major centres as lower multi-unit starts, particularly in Vancouver and Toronto, drove both the SAAR and Trend down in June. While strong starts growth in June and the first half 2024 in Calgary, Edmonton, and Montréal mitigated some of these decreases, we expect continued downward starts pressure across Canada throughout 2024,” said Bob Dugan, CMHC’s Chief Economist.

Key Facts:

- The monthly SAAR of total urban housing starts (centres with population above 10,000) was 9% lower with 223,234 units recorded. Multi-unit urban starts decreased 12% to 180,205 units, while single-detached urban starts increased 2% to 43,029 units.

- The rural starts monthly SAAR estimate was 18,438 units.

- Total SAAR housing starts were up 23% in Montréal, driven by a 26% increase in multi-unit starts. Vancouver declined 13%, due to decreases in multi-unit starts. Toronto decreased 37% with multi-unit starts lower.

- Monthly Housing Starts and Other Construction Data are accessible in English and French on our website and the CMHC Housing Market Information Portal.

- Housing starts data is available on the eleventh business day each month. We will release the July housing starts data on August 15 at 8:15 AM ET.

- CMHC uses the trend measure as a complement to the monthly SAAR of housing starts to account for considerable swings in monthly estimates and to obtain a clearer picture of upcoming new housing supply. In some situations, analyzing only SAAR data can be misleading, as the multi-unit segment largely drives the market and can vary significantly from one month to the next.

- Definitions and methodology to better understand the foundations of the Starts and Completions and Market Absorption surveys.

As a trusted source of housing information, CMHC provides unbiased housing-related data, research, and market information to help close knowledge gaps, and deepen understanding of complex housing issues to inform future policy decisions.

Housing starts facilitate the analysis of monthly, quarterly, and year-over-year activity in the new home market. The data we collect as part of our Starts and Completions and Market Absorption surveys helps us obtain a clearer picture of upcoming new housing supply and is used as part of our various housing reports.