At today’s meeting, the Town of Huntsville’s General Committee approved the 2024 Consolidated Budget, which includes the operational and capital expenses and revenues for the Town for the coming year, pending ratification by Council later this month. The Town’s annual budgetary process outlines investments in projects and the cost to maintain Town assets and service levels. It provides Council and the public with an overarching view of all expenditures and helps inform decision-making when it comes to prioritizing needs in the community.

“Serving a growing Huntsville is our priority! Our 2024 Budget will maintain existing levels of service so residents will continue to have access to the Town programming they know and love. Huntsville is progressive, we are also preparing the community to meet our future needs,” says Mayor Nancy Alcock. “The Town’s 2024 Budget prioritizes community needs while recognizing our residents are feeling inflation too. Despite rising costs, Huntsville will continue to provide excellent value for taxpayer dollars. The proposed 2024 tax rate would maintain Huntsville’s position as the lowest projected municipal tax rate of the Towns in the region.”

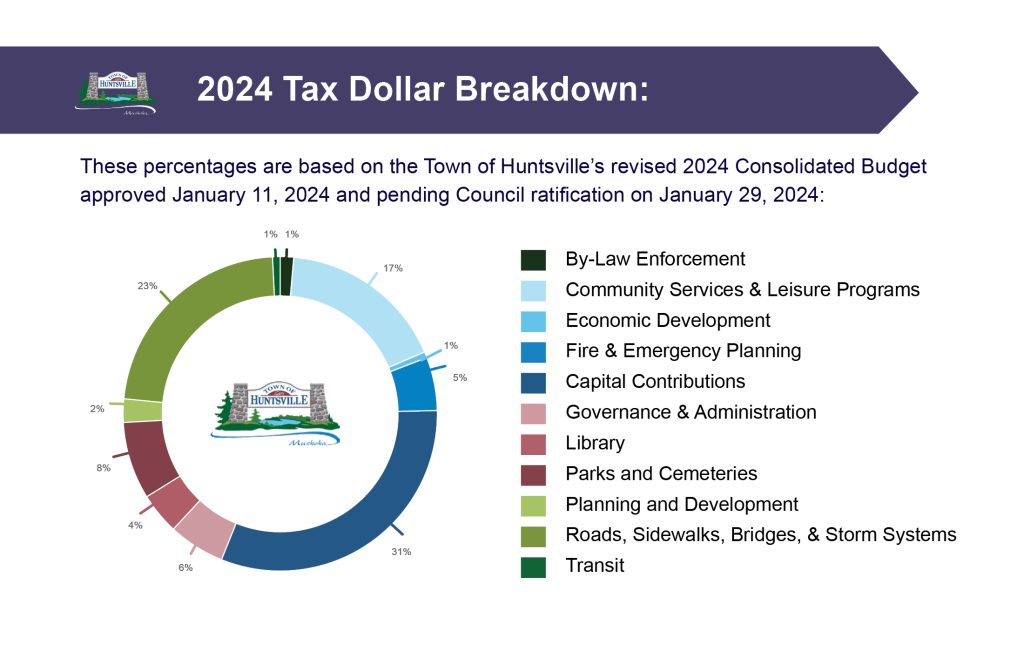

The tax dollars allocated during the Town’s budgetary process go to support municipal services such as: Capital Contributions to fund Town Infrastructure, including Municipal Buildings, Roads, Bridges, Sidewalks, Emergency Vehicles, Maintenance Vehicles, and many others; Operations & Maintenance of Roads, Sidewalks, Bridges, & Stormwater Systems; Recreation, Arts & Culture Programs; Parks & Cemeteries; Fire & Emergency Services; Huntsville Public Library; Transit; Economic Development; and Town Administration & Governance.

Where do your tax dollars go? Breakdown of municipal services supported in the Town’s 2024 Draft Consolidated Budget

“The Town is not immune to external factors such as inflation and growth, resulting in a higher tax rate than previous years to support existing service levels. Our 2024 Budget, as approved by General Committee, prioritizes maintaining services and supporting infrastructure while making an effort to balance the impact to our taxpayers. It all comes down to prioritizing the needs of our community, keeping in mind the fiscal challenges that are being experienced by all of us.” shares Denise Corry, Chief Administrative Officer at the Town of Huntsville. “Our new tax rate continues to make Huntsville one of the most competitive municipal tax rates in the province for a town of our size.”

The Draft 2024 Consolidated Budget went through a multi-stage debate and approval process with General Committee. The Draft Budget was first presented by Town Staff at a Special General Committee Meeting on December 12, 2023. The initial proposed net tax rate increase was 15.26%. General Committee then provided direction to staff with measures to reduce the net tax rate increase to 10.89%. Town Staff then prepared a Revised Draft 2024 Budget, which they presented at a Special General Committee Meeting on January 11, 2024, with a proposed tax rate increase of 10.68%, which was subsequently approved by General Committee. The Draft 2024 Budget will now be sent to Council for approval at the January 29 meeting.

The highlights of the Town’s 2024 Consolidated Budget include:

- Proposed municipal tax rate increase of 10.68%

- Includes an overall increase of $672,200 for Capital funding to support the Town’s capital infrastructure

- Includes ongoing commitment to Hospital Local Share, in the amount of $230,000

- Would result in an estimated net tax rate impact overall on the tax bill of 6.64% (including estimated District and Education rates)

- Overall impact translates to an additional $137 per $300,000 of property value per household per year

“We need to right-size our budget. A tax rate that maintains the same levels of service to our growing community is essential, even though this will result in an increase,” says Julia McKenzie, Director of Financial Services and Treasurer at the Town of Huntsville. “The Town has endeavored to provide consistent tax rates during pandemic and post-pandemic years to minimize the financial impact to residents. Unfortunately, now we are forced to make up for this, due to inflation and the Town’s growth. Failure to allocate sufficient funds to maintain basic levels of services in an inflationary environment will have a negative compounding effect.”

As discussed by Council & Town Staff during the budgetary process, the many factors that impacted the 2024 Budget include the following:

- The population of the Town of Huntsville has grown 11% from 2014-2021.

- Cost of materials has risen dramatically, for example the cost of road building and line painting materials has risen 44-65% from 2021-2023

- The inflation rate from 2021-2023 was 4.75%, as compared with a rate of only 1.66% from 2018-2020

- Decrease in COVID relief funding – one-time funding from 2023 removed from the budget, representing a change in reserve funding

- The Community Services division is seeing increased demand for use of facilities and programs, representing an 11-100% growth in usership across various programs

For a more detailed breakdown of the 2024 Consolidated Budget, please visit the meeting agenda on Huntsville.ca or visit the Budget and Finances page on the website.