- Thirty-five per cent are not confident they will achieve their financial life goals

- Planning pays off: Three quarters of Canadians working with a financial planner are confident they can withstand a financial emergency

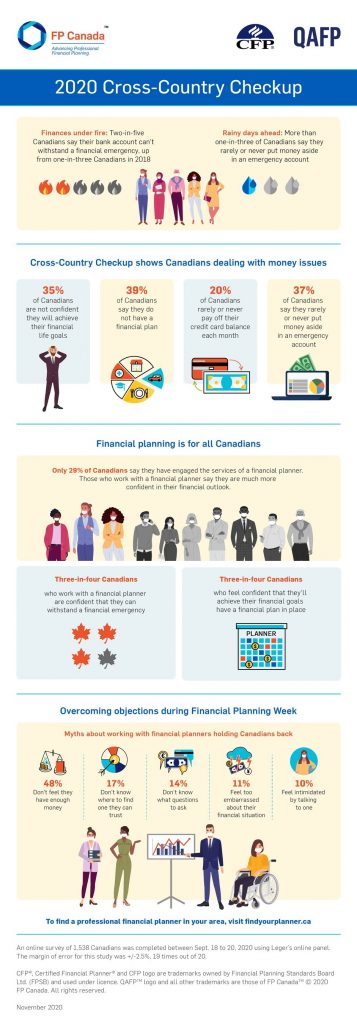

Canadians are feeling the financial pinch, with nearly two out of five (39%) reporting that their bank accounts cannot withstand a financial emergency, according to the newly released FP Canada Cross-Country Checkup, a new national survey by FP Canada™. The finding marks a significant increase from only two years ago, when 33% said they couldn’t handle a sudden financial shock.

The FP Canada Cross-Country Checkup is commissioned every two years and has been released to mark Financial Planning Week, which takes place from Nov. 15-21. Given ongoing uncertainty and economic damage caused by COVID-19, 2020 has proven that Canadians need to have a plan in place to help secure their financial well-being in good times and bad – though four-in-ten say they don’t have a financial plan (39%).

“This is an opportune time to take a hard look at how people are faring with their finances,” said Mark Halpern, Certified Financial Planner®. “Given the whirlwind year we’ve had, it’s no wonder that people are feeling stressed about their financial situations. It is also not surprising that the percentage of Canadians who cannot afford a financial emergency has gone up since the last FP Canada Cross-Country Checkup in 2018. Now more than ever, it’s important to put a plan in place so that household fiscal burdens don’t become too overwhelming.”

Canadians aged 45-54 are the most pessimistic, with more than half (53%) saying they could not handle a financial emergency — well surpassing the national average. Adding to the problem is the fact that almost four in 10 (37%) Canadians say they rarely or never put money aside in an emergency account.

Financial planning goes a long way

The new research once again highlights that people who work with a professional feel much more confident when it comes to money matters. Among those who have updated their financial plan, 71% are confident that they will achieve their financial goals.

Financial planning can help everyone at every age and stage in life. But there are some misconceptions among Canadians about seeking professional advice. Almost half (48%) of those who don’t currently work with a financial planner say they would do so if they had more money. Uncertainty around where to find a professional they can trust (17%) and what kinds of questions to ask a financial planner (14%) were also noted barriers for many Canadians in turning to experts to help improve their financial well-being.

“All Canadians can benefit from planning their finances – whether it’s to determine how much money should go into an emergency fund, buying a home, paying for post-secondary education or choosing to pull money from an RRSP,” said Wendy Brookhouse, Qualified Associate Financial Planner™. “Seeking the advice of a CFP® professional or QAFP™ professional will help you map out your current financial situation and plan for the future so that unexpected emergencies don’t veer you too far off course. Putting a plan in place helps build a resilient household budget, helps you reach your financial life goals and ensures you’re always prepared to recover from any sudden financial shift.”

Prairies most pessimistic about achieving financial goals

This year has been one of uncertainty and instability with the survey revealing 35% of Canadians aren’t confident they will achieve their financial life goals. People in the Prairies (Manitoba and Saskatchewan) surpass the national average, with almost half (45%) reporting a lack of confidence. The new findings are consistent with the 2018 Cross Country Checkup, which also revealed the Prairies were the least confident.

Despite these trends, 71% of Canadians report that they haven’t engaged the services of a professional financial planner. That number is highest in Québec (80%) and the lowest in British Columbia (60%) and Alberta (64%). The survey revealed that not having a big enough portfolio is the top reason Canadians do not seek out the services of a professional financial planner (29%).

With the start of Financial Planning Week, it’s important to remember that every Canadian can benefit from professional financial planning to set them on a course to achieve life goals through the proper management of their finances.

Other notable findings from this year:

- Two-thirds (67%) of Canadians were confident they would achieve their financial goals back in 2018, but just over half (57%) say the same today — a significant drop in only two years.

- 20% of Canadians (the same as in 2018) rarely or never pay off their credit card balance each month — that number is highest in Atlantic Canada (29%) (similar to 2018) and lowest in Alberta (15%). Quebec was the lowest at 17% in 2018.

- Six-in-10 (61%, compared to 62% in 2018) rarely or never maximize their RRSP contribution each month based on eligible amounts — that number is highest in Ontario (65%) and lowest in Manitoba and Saskatchewan (52%). Interestingly, in 2018, Ontario was in the lowest at 57% and Atlantic Canada was the highest at 67%.

- One-in-three (32% compared to 33% in 2018) rarely or never set aside savings at the end of the month, after all expenses have been paid — that number is highest in Atlantic Canada (37%) (42% in 2018) and lowest in B.C. (29%) (30% in 2018).